What is a wealth tax and would it work in the UK?

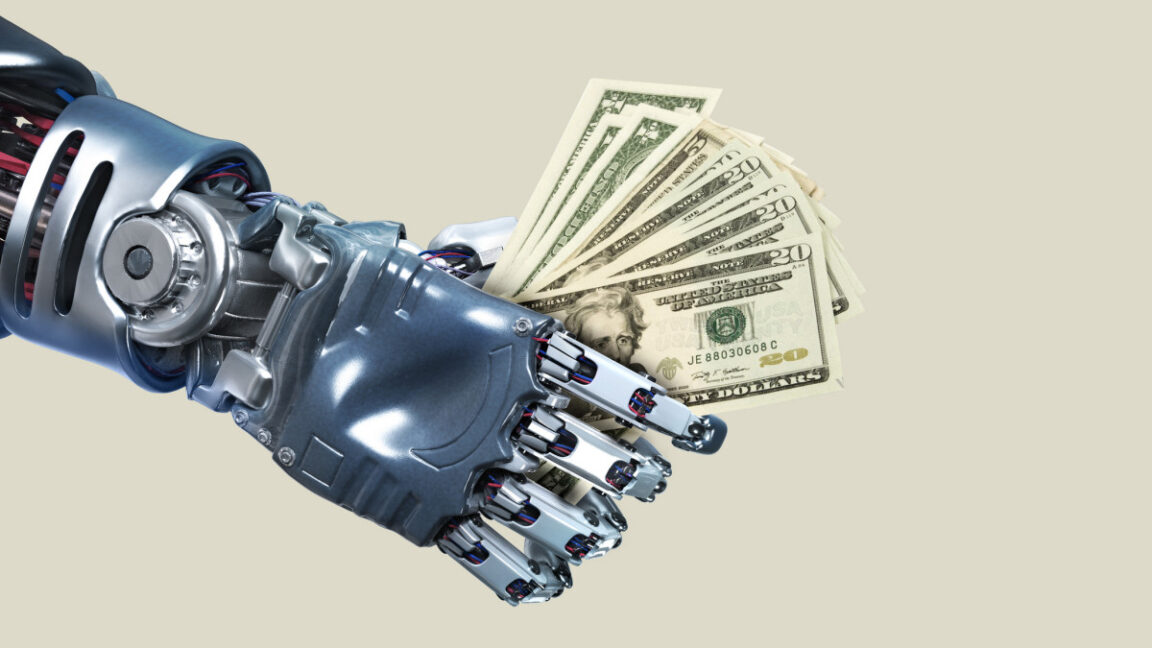

A wealth tax is an annual levy on an individual’s total net assets – property, investments, cash, even antiques or art – above a given threshold. The idea is to directly target accumulated wealth, not just income. In the UK there are already some taxes on wealth – inheritance tax, capital gains tax, and council tax – that could be tightened up before a new tax is introduced.

A modest wealth tax aimed at the ultra-rich, for example those with assets over £10m, could generate significant funds. One study suggests a global levy on the top 0.5% could raise about $2.1tn – roughly 7% of national budgets – with the UK alone bringing in around $31bn a year. That revenue could be transformative if used to fund the NHS, education, affordable housing, climate resilience, and long-term care.

There is also a political benefit: by launching something new with a specific name, it would appeal to the majority of voters who back higher taxes on the very rich.