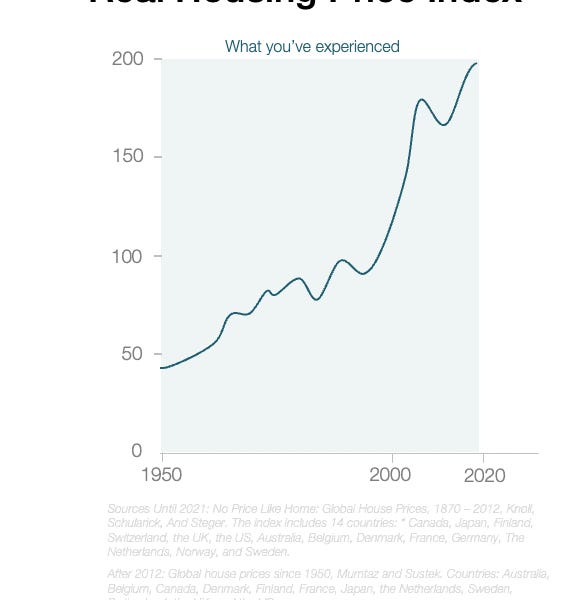

Homeowners got $2 trillion richer during the first three months of the year

Those with mortgages — about 62% of all properties — saw their equity jump by 20% in the first quarter from a year earlier, according to CoreLogic. This represents a collective cash gain of close to $2 trillion. Per borrower, the average gain was $33,400.

The massive gain is thanks to soaring home prices, which CoreLogic said were up over 11% in March, the end of the quarter, from a year earlier. That's the sharpest gain since 2006. Prices rose an even stronger 13% in April.

High demand for homes spurred by the coronavirus pandemic amid an already low supply caused bidding wars in markets across the nation. Record-low mortgage rates for much of last year only added to the buying frenzy and helped fuel the price gains.

"Homeowner equity has more than doubled over the past decade and become a crucial buffer for many weathering the challenges of the pandemic," said Frank Martell, president and CEO of CoreLogic. "These gains have become an important financial tool and boosted consumer confidence in the U.S. housing market, especially for older homeowners and baby boomers who've experienced years of price appreciation."

As of June 1, there were still just over 2 million homeowners in Covid-related mortgage bailout programs, according to the Black Knight real estate data company. As these plans begin to expire, having home equity will help those in trouble. They can still sell and get out with a potential profit if they have to.