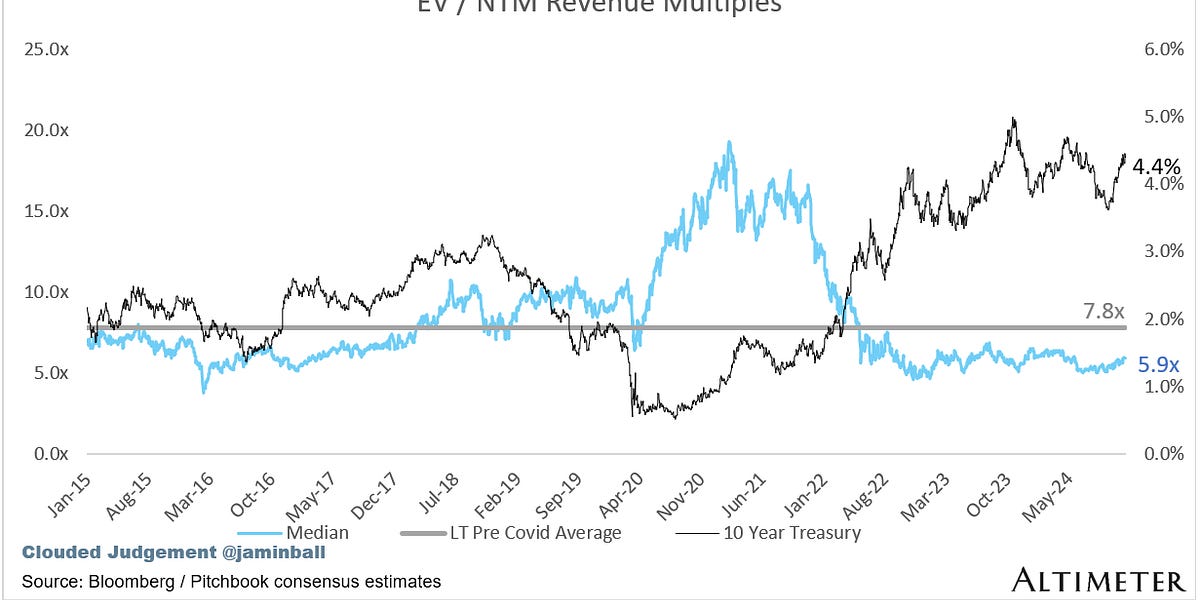

Clouded Judgement 11.14.24 - Market Tipping to Growth

I think the market and companies are starting to shift focus towards growth. Over the last 2 years there has been a big shift in how software companies value growth vs profitability. Growth was the sole focus in the ZIRP period, and as we came out of that period there was a renewed focus on profitability. So what have been the results? The chart below shows LTM FCF margins. As you can see, a huge percentage of the public software companies are now FCF profitable. This is a huge shift from a couple years ago. Software companies, for the most part, showed they were able to drive real operating leverage.

But FCF doesn’t come free. It generally comes at the expense of growth. And over the last few years growth has come down a lot. Of course macro had a much bigger impact on growth (it got a lot harder to sell software), but companies also focused more on driving efficiency than driving growth. The chart below shows how median growth rates have come down

But something interesting has happened recently. It would appear that leading indicators show that companies are starting to lean back into growth. AND simultaneously, the market isn’t valuing profitability in the same way it did over 2023 and early 2024.