AI infrastructure stocks are poised to be the next phase of investment

Interest in generative artificial intelligence is intensifying, as measured by internet search volumes, news stories, and more discussion of the topic than ever before on fourth-quarter earnings calls. The economic potential of the new technology has helped lift the stock market to new highs, led by Nvidia, the maker of specialized chips that are crucial to run generative AI models.

Now a key question for investors is: What happens next as the AI rally broadens to involve more companies? According to Goldman Sachs Research, if Nvidia represents the first phase of the AI trade, Phase 2 will be about other companies that are helping to build AI-related infrastructure. Phase 3 deals with companies incorporating AI into their products to boost revenue, while Phase 4 is about the AI-related productivity gains that should be possible across many businesses.

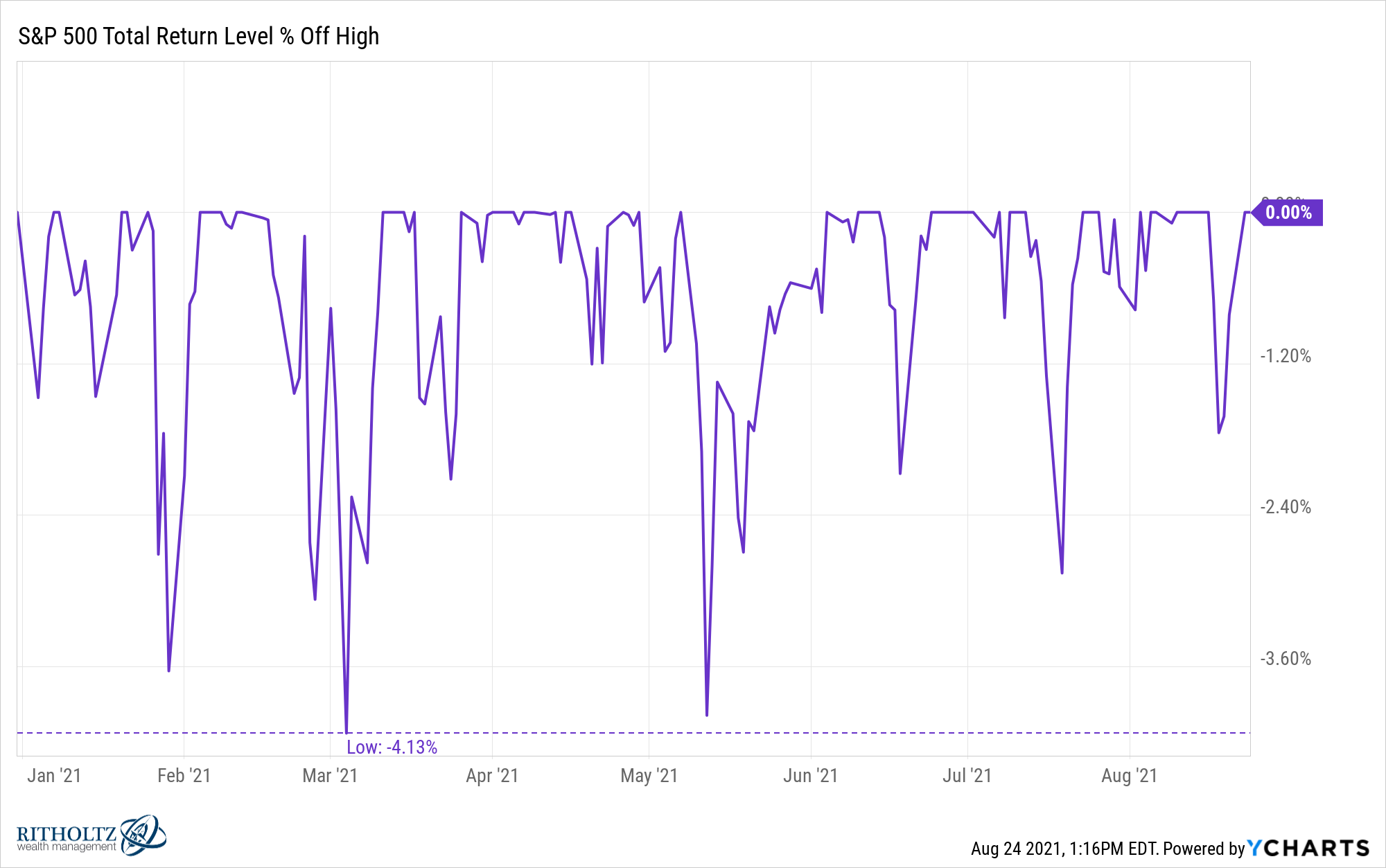

So far, investor optimism isn’t running as high as it was at prior peaks in 2000 and 2021, Goldman Sachs Research strategist Ryan Hammond writes in the team’s report. The implied level of long-term earnings growth that investors expect has climbed to 11% a year. That’s above the long-run average of 9% but still below the 16% percent growth that was expected at the height of the technology bubble in 2000 or the 13% growth implied by stock prices at the peak of the post-Covid rally in 2021. The analysis is based on the relationship between return-on-equity and price-to-book, to quantify the long-term growth in earnings implied by how the market is priced today.

:focal(0x0:3200x2133)/static.texastribune.org/media/files/ed5ccc3f096b38c0a1e29fe677bdfda1/0229%20Panhandle%20Fire%20MR%2008.jpg)