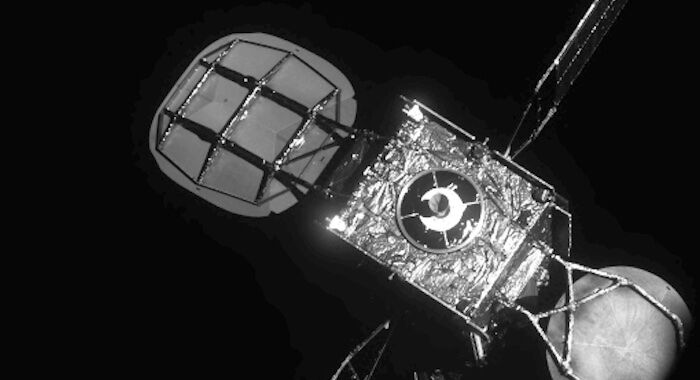

Two giants in the satellite telecom industry join forces to counter Starlink

Facing competition from Starlink and other emerging satellite broadband networks, the two companies that own most of the traditional commercial communications spacecraft in geostationary orbit announced plans to join forces Tuesday.

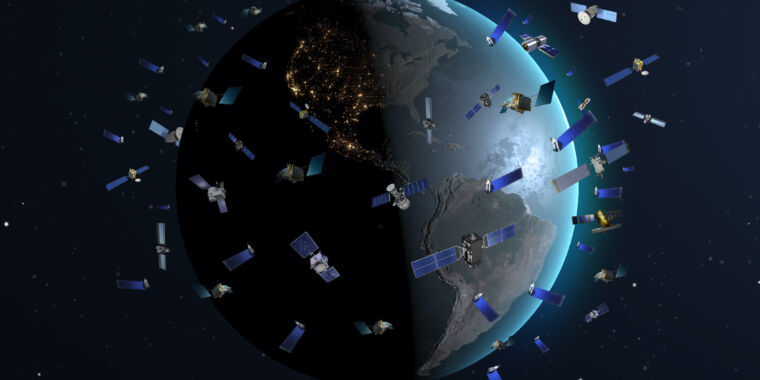

SES, based in Luxembourg, will buy Intelsat for $3.1 billion. The acquisition will create a combined company boasting a fleet of some 100 multi-ton satellites in geostationary orbit, a ring of spacecraft located more than 22,000 miles (nearly 36,000 kilometers) over the equator. This will be more than twice the size of the fleet of the next-largest commercial geostationary satellite operator.

The problem is that demand is waning for communication services through large geostationary (GEO) satellites. There are some large entrenched customers, like video media companies and the military, that will continue to buy telecom capacity on geostationary satellites. But there's a growing demand among consumers, and some segments of the corporate and government markets, for the types of services offered by constellations of smaller satellites flying closer to Earth.

The biggest of these constellations, by far, is SpaceX's Starlink network, with more than 5,800 active satellites in its low-Earth orbit fleet a few hundred miles above Earth. Each of the Starlink satellites is smaller than a conventional geostationary platform, but linked together with laser communication terminals, thousands of these spacecraft pack enough punch to eclipse the capacity of internet networks anchored by geostationary satellites. Starlink now has more than 2.6 million subscribers, according to SpaceX.